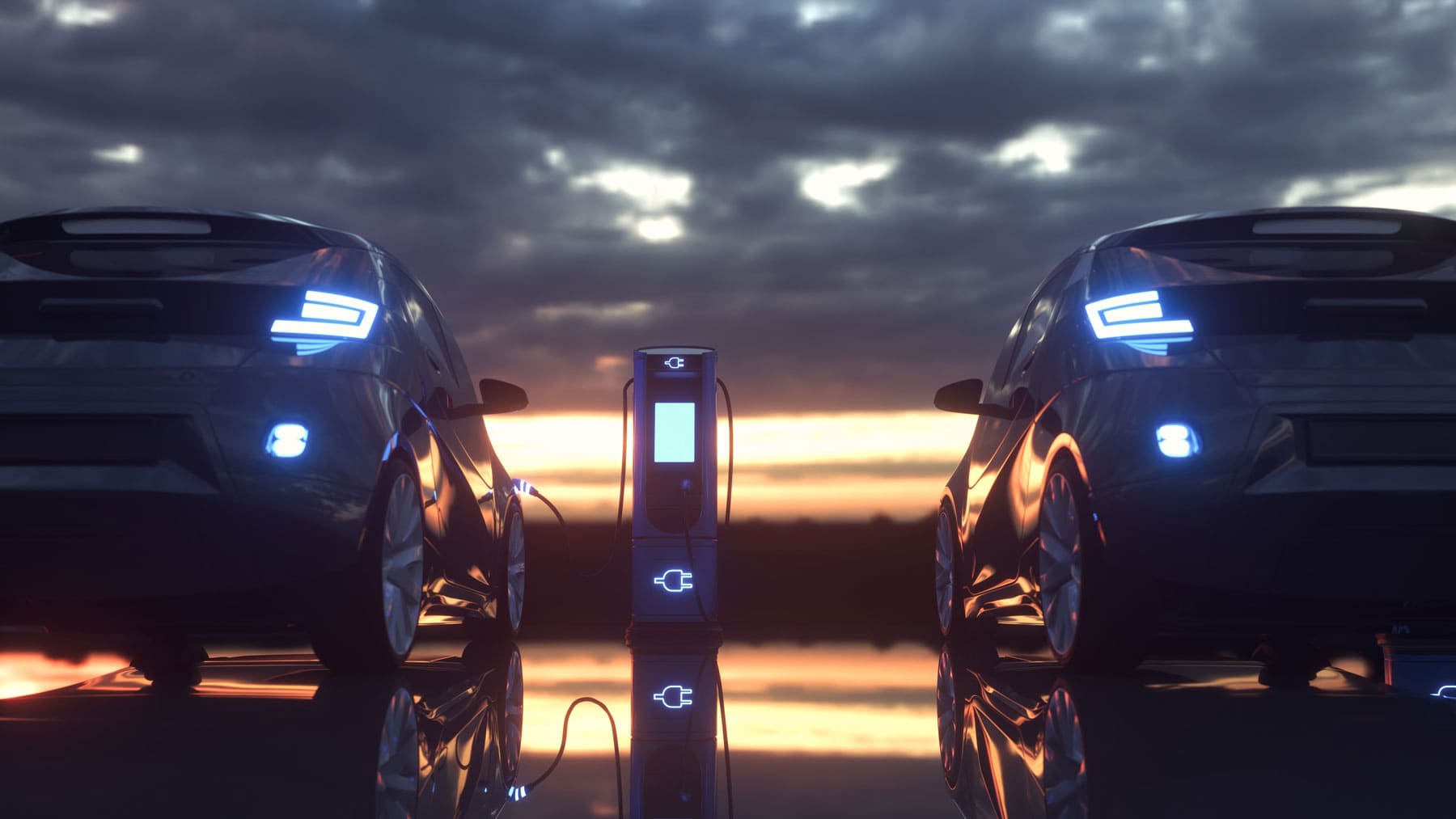

At Positive Salary Packaging, we often get asked by clients about what items can be included in their novated lease to help maximise their tax benefits. One of the key benefits of the novation is the budgeting component that helps remove large expenditures on the anniversary of your vehicle purchase. The cycle of having an annual service, rego payment and insurance payment all within a month can be hard on the household budget. The following is a list of items that are eligible to include in your vehicles budget

Vehicle Finance Payment – This one is fairly obvious, but the length and term of your novated lease will determine the best possible tax benefit. It’s best to work out a few scenarios to ensure that you are making the most of the available concessions and still balancing personal affordability.

Registration – Your annual registration bill including the CTP can be claimed and paid using your pre-tax income via the novation.

Comprehensive insurance – the annual or monthly bill can be claimed and reimbursed for your budgeted expenditure. Also, if you do have to make a claim on your vehicle, the excess payable can be also claimed if sufficient funds are in your account.

Servicing – when setting up the novation your fleet consultant will look at the individual cars running costs for not only scheduled service but the perishable items as well. Items such as brakes and wiper inserts need to be budgeted to allow for replacement towards the end of many leases. By spreading out the service cost of the life of the lease it can help ease the cost over the ownership period to ensure major services are budgeted for and taken care of.

Tyre Replacement – Tyre usage and wear will depend on the type of vehicle that you have chosen, your driving style, your commute, distance travelled each year and your location. It is important to ensure that you have the correct budget to replace the tyres as per your personal need.

Auto Club Membership – If your vehicle comes with a roadside assistance program this may not be required, but many of the manufacturers only offer a limited program. It could be worthwhile keeping your existing program in place and this item can be paid using pre-tax income. Even if you choose to extend the manufactures program past the initial term, this can also be claimed.

Ad hoc expenditure – Items such as car washing and detailing can also be claimed so there is no excuse to make sure your new vehicle is not looking its best. Items that are replacement parts of the initial vehicle can also be claimed eg a cracked taillight. Items that are ancillary and not on the vehicle at the point of delivery can not be claimed eg a bull bar or tow pack

If you are ever in doubt about what items can or can’t be claimed drop a line to our friendly feet team and they can help check the items and eligibility to ensure that you are making the most of your pre-tax income.

Positive salary packaging is here to drive your income further.