Who is this for

For professionals who use their personal car for business purposes, Novated Leases, combined with the operating cost method, offer a strategic leasing solution. The more one uses their vehicle for business travel, the greater the savings. Salespeople, consultants, and real estate agents capitalise on frequent travel benefits. Medical professionals, contractors, and field engineers value it for moving between work locations. Regional managers, mining workers, educators, agricultural experts, public speakers, and researchers leverage these leases for diverse commutes, merging personal and business use with flexibility and cost-efficiency.

Operating Cost Method Novated Lease vs. Traditional Novated Lease

What’s the difference?

The primary distinction between the two methods lies in the way business use is accounted for:

The Operating Cost Method Novated Lease allows employees to use their personal car for business purposes and specify a business use percentage. This percentage indicates how much of the car’s use is for business-related activities. The higher the business use percentage, the greater the potential tax savings, making it a highly efficient option for those who use their personal vehicle substantially for work.

In contrast, the Traditional Novated Lease does not take into account the specific percentage of business use. It provides tax benefits through salary packaging but doesn’t offer the added advantage of adjusting for a business use percentage, which can lead to maximised tax savings in the Operating Cost Method.

Why Employees Love It

- Significant Tax Savings: Maximise deductions through salary packaging.

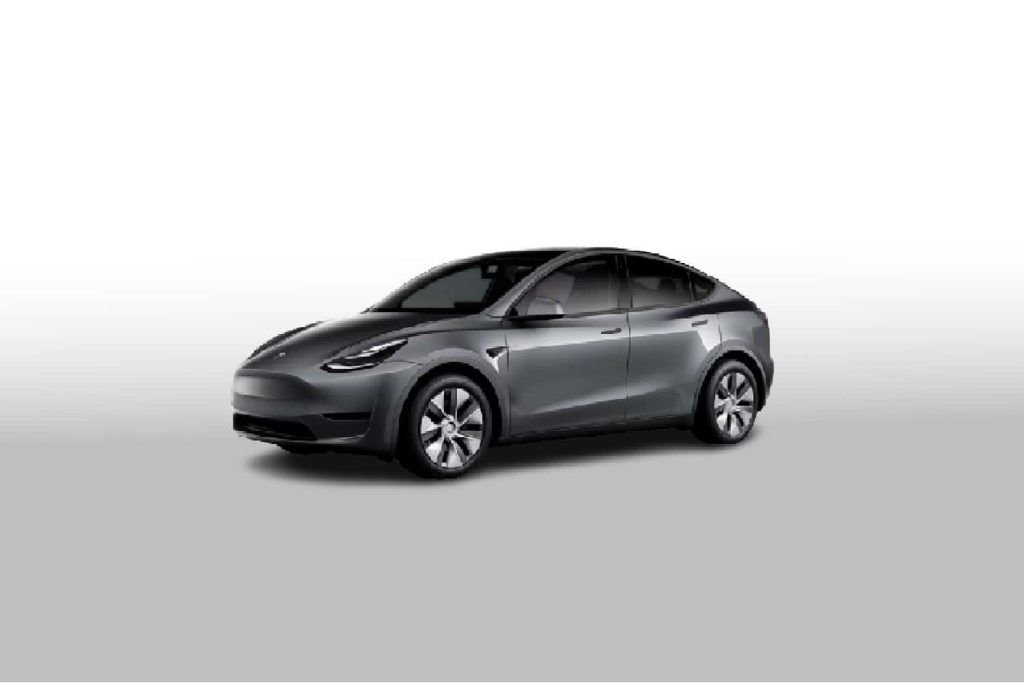

- Freedom in Vehicle Selection: Choose a car that resonates with your style.

- Hassle-Free Experience: All vehicle-related expenses are bundled for convenience.

- Flexibility: Easily transfer the lease between employers if job changes occur.

How Employers Benefit

- Reduced Administrative Burden: Minimise the hassle of fleet management.

- Attractive Employee Perk: Offer a competitive advantage in employee attraction and retention.

- No Residual Risk: Eliminate concerns about vehicle resale values.

- Financial Efficiency: Keep liabilities off the company’s balance sheet.

Common questions

This method is a type of vehicle leasing arrangement where employees can lease their personal car through salary packaging. It factors in a specified business use percentage, allowing for potential tax benefits based on how much the vehicle is used for business purposes.

The primary difference is the inclusion of a business use percentage in the Operating Cost Method. This percentage signifies how much of the car’s use is for business activities. The higher this percentage, the greater the potential tax savings.

The business use percentage directly impacts the potential tax savings one can achieve. A higher business use means a larger portion of the vehicle’s expenses can be claimed, leading to more significant tax benefits.

Users can expect tax benefits arising from salary packaging the vehicle and its running costs. The exact savings will depend on factors like salary, car expenses, and the specified business use percentage.

Yes, one of the advantages of the Novated Lease Operating Cost Method is its flexibility. If you change jobs, you can typically transfer the lease to your new employer.

Employers can benefit in several ways, including reduced fleet management responsibilities, potential GST credits on operating costs, and the ability to offer an attractive incentive for employee attraction and retention.

No, the Novated Lease Operating Cost Method is different from a Business Operating Lease. A Business Operating Lease is an agreement where a business leases a vehicle for a set period, after which the vehicle is returned to the lessor. In contrast, the Novated Lease Operating Cost Method is an arrangement between an employee, employer, and a leasing company, where the employee can lease their personal vehicle through salary packaging, factoring in a business use percentage for potential tax savings.

You are the registered and insured owner of the vehicle therefore the decision of who drives it is entirely yours!

Fringe Benefits Tax does not apply to a novated lease.

No, as long as you pay tax, you will benefit.

- Upgrade your vehicle

- Extend your current package for another term

- Payout the remaining residual

- Own the vehicle outright with Residual – Free option

Yes, you can lease a used car using this method. However, the specific terms and conditions might vary based the age or condition of the used vehicle. It’s essential to check with your us for the exact requirements and potential limitations.

It is possible to switch from a car loan to a Novated Lease. The specifics will depend on the terms of your current loan, any early repayment fees, and the agreement with your leasing provider. Consulting with Positive Salary Packaging will give you a clear picture of the steps involved and any associated costs.