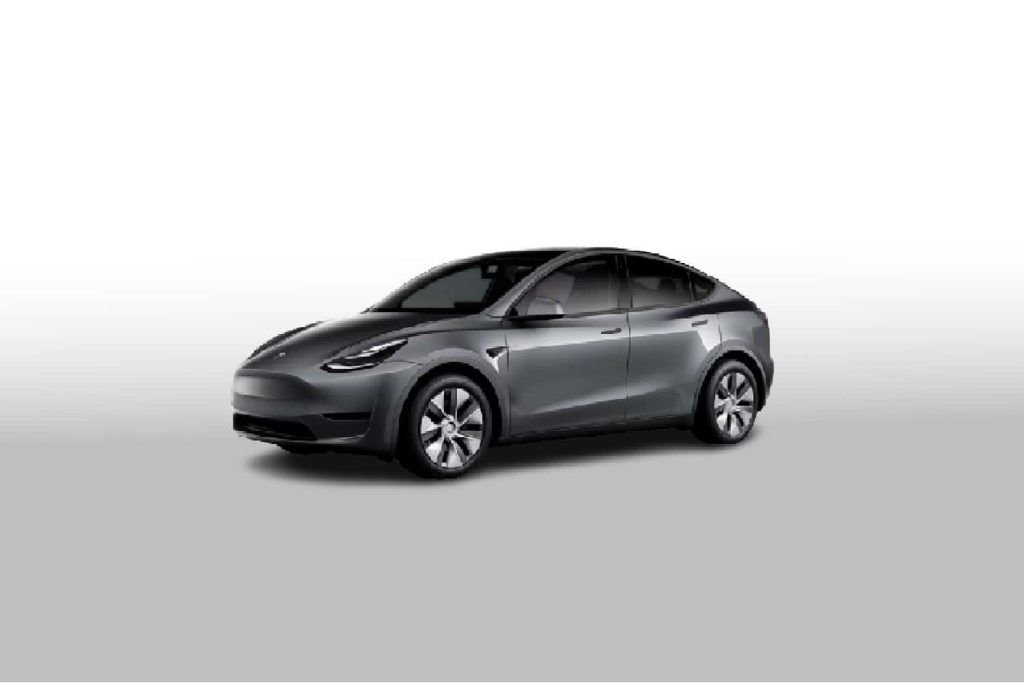

Browse our range of available vehicles

Filter by

Common questions

The FBT exemption on EVs allows an employee to pay for their vehicle using pre-tax only and not FBT or post-tax offset (ECM).

Your vehicle basically becomes fully tax-exempt (up to the Green luxury car tax limit), as long as it meets the conditions. This means a full pre-tax payment on your finance, rego, insurance, tyres, servicing and charging costs. It also entitles you to claim all the GST costs associated with these expenses via your employer.

Your employer has to process one pre-tax payment to PSP. No reporting, no hassles and no fuss. Talk with our Operations Manager about how easy this is to set up. Phone 1300 946 527.

This is a quick way to help increase an employee’s net pay and reduce household costs.

We can contact your payroll and help set up this benefit. If your employer can set up and pay an extra superannuation deduction, they can set up an EV novated lease. We work with all payroll software such as reckon, MYOB and Xero.

Yes, you can claim your electricity costs when using a public EV charging station. Our vehicle expenses card allows you to pay directly from your salary packaging account without having to claim and reimburse. You can also claim charging costs at home if you have a separate meter for vehicle charging in order to separate the household and vehicle costs.

This benefit could potentially reduce your taxable income and reduce the total on your payment summary resulting in a lower taxable income you may receive a Reportable fringe benefits amounts (RFBA) which can affect things such as family tax benefit and child support payments

Hybrid Vehicles still utilise a petrol engine for the majority of power use and the battery engine for low-speed usage eg around shopping centres or on light highway driving, depending on the model.

It costs a lot less in “fuel or charging” costs to run an EV compared to an ICE vehicle, but costs are higher for items such as insurance and tyres. This is due to the higher premiums charges on EVs for comprehensive insurance and the general value of the vehicles being much higher in the initial purchase price. As an example, a Tesla 3 standard attracted an approx insurance cost of $1,600 per annum for a 35-year-old male based in Adelaide.

Positive Salary Packaging has also found a greater cost in tyre replacement and tyre wear with an increase in wear rate of approx. 25% compared to an ICE equivalent. These items are figured in the lease with pre-tax payments. The significant saving is in the charging vs bowser cost, with most drivers saving approx $2,900 per annum in cost.

Most EVs will come with a base-level charging system for your home using a standard 10 amp plug that can be utilised for your vehicle. Many clients simply add the wall-mounted unit for anywhere between $700 to $1,500 plus installation costs dependent on the brand of vehicle. This results in a much quicker charge and allows maximum efficiency when charging your vehicle.

The main model people think of vehicle is Tesla, but there are offerings from MG, BMW, Porsche, BYD and Polestar. Many manufacturers are in the process of bringing new models to the country as the initial sales of EVs start to increase and the national charging network continues to grow.

We believe that as the demand for vehicles grow and more manufacturers bring vehicles for sale in the country, the cost of the vehicles will drop slightly. Along with manufacturers being in vehicles with small car sizing too which will reduce the initial purchase cost.

This will vary on the size of the battery in the vehicle and the rate that it is being charged. Supercharging stations in some cases may be able to charge 50% of the battery within 30mins in some cases. Whilst a slow charging 10 amp fitment could take up 6-7 hours to achieve the same level.

This will vary from model to model but some models are now able to travel up to 600+ kms on a single charge. Most people adopting this technology are CBD or Urban based motorists that are using the car for commuting and on average may only commute 50-100kms per day that works perfectly for them, giving lower running costs and fewer emissions.

Batteries across many of the vehicles currently on the market have warranties of up to 4-8 years dependent on the brand. Long-term battery replacement is yet to be seen on many EVs on a wide-scale basis as the vehicles are so new to the market. This is something that can only be seen in the early hybrid vehicles, that occurred around the 10-year mark. In saying this, the level of technology and battery has greatly advanced in the last ten years, similar to that of mobile phones and laptop computers.

Whilst it may seem dangerous, the battery packs of Australia-delivered vehicles have met all the ANCAP-based requirements and ADR regulations for safety. These are no different in risk from standard petrol ICE vehicle that has 50-60 litres of high flammable liquid in the rear.

Not many of the initial EVs on the Australian market have been designed as towing vehicles, some have the ability for towbar style hitch, but this is more for external storage of items such as Bicycles. We expect this to change as larger more traditional manufacturing brands such as GM and Ford come to the market with more fit to purpose vehicles over the coming 18-24 months.

A great place to start is on the manufacturer’s website and national motoring bodies’ websites, like everything internet-based forums, can be very one-sided articles based upon personal bias either for or against. Like all vehicles, it’s best to go to the showroom and sit, look feel, drive and touch the car to make sure that it meets your end goals.

Novated Leases for car brands

We provide Novated Leases for all electric car brands, including the ones listed below