Your situation

Unlock Exclusive Savings

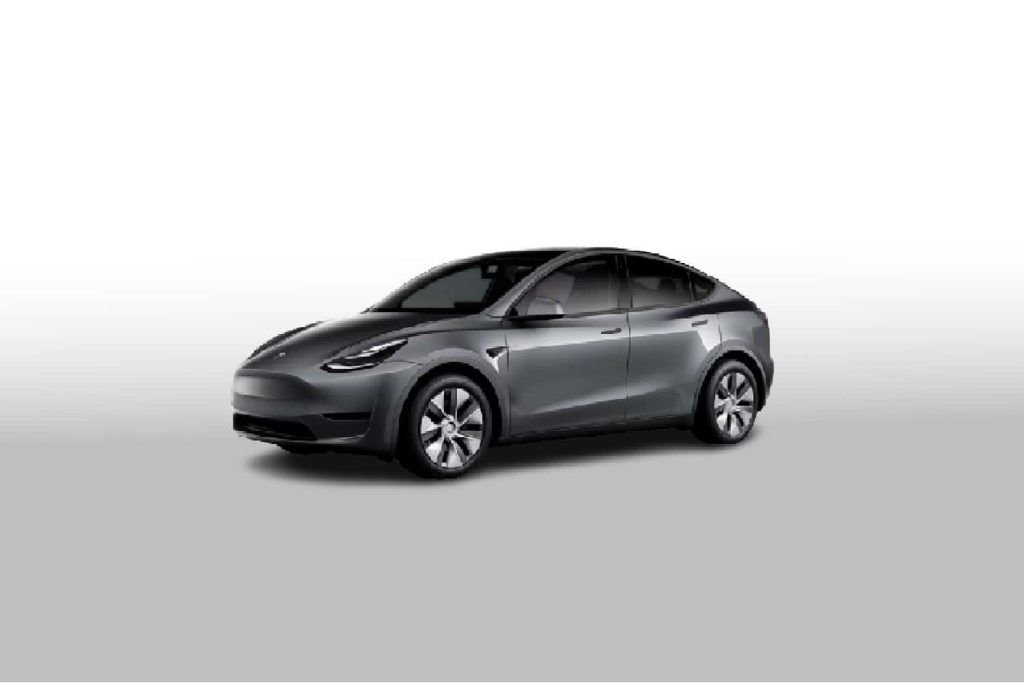

Novated Leasing for Invest Blue Staff

Discover how our Novated Lease Solutions are tailored to provide exceptional savings and convenience for Invest Blue’s worforce, empowering tax savings and the benefits of tax savings for your everyday motoring.rnIn partnership with Positive Salary Packaging, Invest Blue offers employees various salary packaging benefits, aiming to improve their experience. This includes opportunities for financial optimisation such as Novated Leasing and exclusive vehicle expense savings.

Get a Novated Lease Quote

Australia’s Best Vehicle Salary Packaging Solution!

Start saving with a Novated Lease today

- Get discounts on the car

purchase price - Save up to $10,000 vs a traditional 5 year car loan

- Easily convert your existing car loan to a novated lease

- Flexible Visa card for fuel purchases

Unlock huge savings with a Novated Lease today!

Common questions

It is possible to switch from a car loan to a Novated Lease. The specifics will depend on the terms of your current loan, any early repayment fees, and the agreement with your leasing provider. Consulting with Positive Salary Packaging will give you a clear picture of the steps involved and any associated costs.

Yes, you can lease a used car using this method. However, the specific terms and conditions might vary based the age or condition of the used vehicle. It’s essential to check with your us for the exact requirements and potential limitations.

No, the Novated Lease Operating Cost Method is different from a Business Operating Lease. A Business Operating Lease is an agreement where a business leases a vehicle for a set period, after which the vehicle is returned to the lessor. In contrast, the Novated Lease Operating Cost Method is an arrangement between an employee, employer, and a leasing company, where the employee can lease their personal vehicle through salary packaging, factoring in a business use percentage for potential tax savings.

Employers can benefit in several ways, including reduced fleet management responsibilities, potential GST credits on operating costs, and the ability to offer an attractive incentive for employee attraction and retention.